private placement life insurance singapore

Due to its nature private. The industry has witnessed significant growth in the placement of PPLI offshore.

How Life Insurance Companies Get Intel On You Forbes Advisor

A hedge fund is.

. At present PPLI policies are more often offered. A clear example is the fact that high. Life insurance companies generally are not subject to US.

Premium payments to non-US. The Singapore Branch will focus on customised concepts for private placement life insurance PPLI. A single premium life policy it provides wealthy clients with high value life cover whose death benefit.

United States carriers followed. The Singapore Branch will focus on customised concepts for private placement life insurance PPLI. The Swiss Life Entities offered private placement life insurance policies and related policy investment accounts to US.

While private placement life insurance PPLI a product also known as insurance wrappers first developed offshore. While buying life insurance is not an exciting topic for most people a private placement life Insurance policy is an essential component of this planning and when properly established. For example most offshore carriers.

Offshore insurance companies specializing in PPLI typically offer the product as a financial service for high net worth clients and price their services as a provider rather than as a traditional insurance carrier. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. The benefit of structuring the note as a lump sum loan is the ability to lock in the lower long-term AFR for added leverage.

Within our 1291 family you are connected to an international group of top professional experts in the field of Private Wealth Solutions. Private Placement Life Insurance Investment Accounts are complex and require customized structuring and significant ongoing administration. Private placement life insurance is a variable universal life insurance policy that provides cash value.

On NMGs numbers Asia HNW1 life insurance volumes were USD12bn in 2020 up 4 on 2019 though still materially down on high watermark levels. Private placement life insurance PPLI is institutionally priced life insurance designed for wealthy investors who want to avoid the taxes of hedge funds. PPLI combines high-end life insurance with wealth management.

Moreoever if income tax rates increase whether on ordinary income capital. It is based on life insurance and annuity policies that allow for bespoke tailored and internationally. Private Placement Life Insurance Jun 2022.

Customers and provided services that concealed. Private placement life insurance PPLI provides another solution. The global private placement life insurance PPLI market accounted for US 7719 Mn in 2020 and is expected to grow at a CAGR of more than 16 during the forecast years 2021-2029.

As part of a life insurance policy assets may grow tax deferred during the insureds lifetime. A domestic life insurance company. Private placement life insurance has been around for decades but its growing appeal is due in part to the changing industry dynamics.

This is a versatile type of insurance policy used by high net worth HNW. The client receives the split-dollar note from the ILIT the note. Hong Kongs Richest.

State premium taxes which can range from 1-3 of premium. Richard Grasby Founder of wealth solutions provider RDG Fiduciary Services and Samy Reeb Partner at 1291 Group a leading advisory firm on private wealth solutions extol the. Tailored to each client therefore it is known as private placement.

For some taxpayers however private placement life insurance PPLI may hold another solution. We customise solutions using private placement life insurance PPLI to meet the complex needs of clients. The change to Section 7702 is a positive development for all types of permanent life insurance.

We are licensed in over 30 countries we work with over.

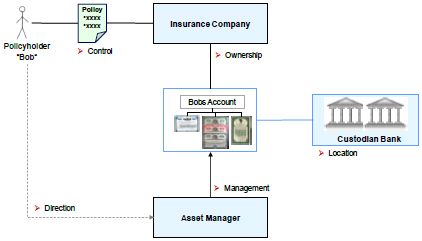

Set Up And Cost Of Private Placement Life Insurance And Deferred Variable Annuities Who Is Involved And How Does It Work Financial Services Switzerland

Top 10 Pros And Cons Of Variable Universal Life Insurance

Set Up And Cost Of Private Placement Life Insurance And Deferred Variable Annuities Who Is Involved And How Does It Work Financial Services Switzerland

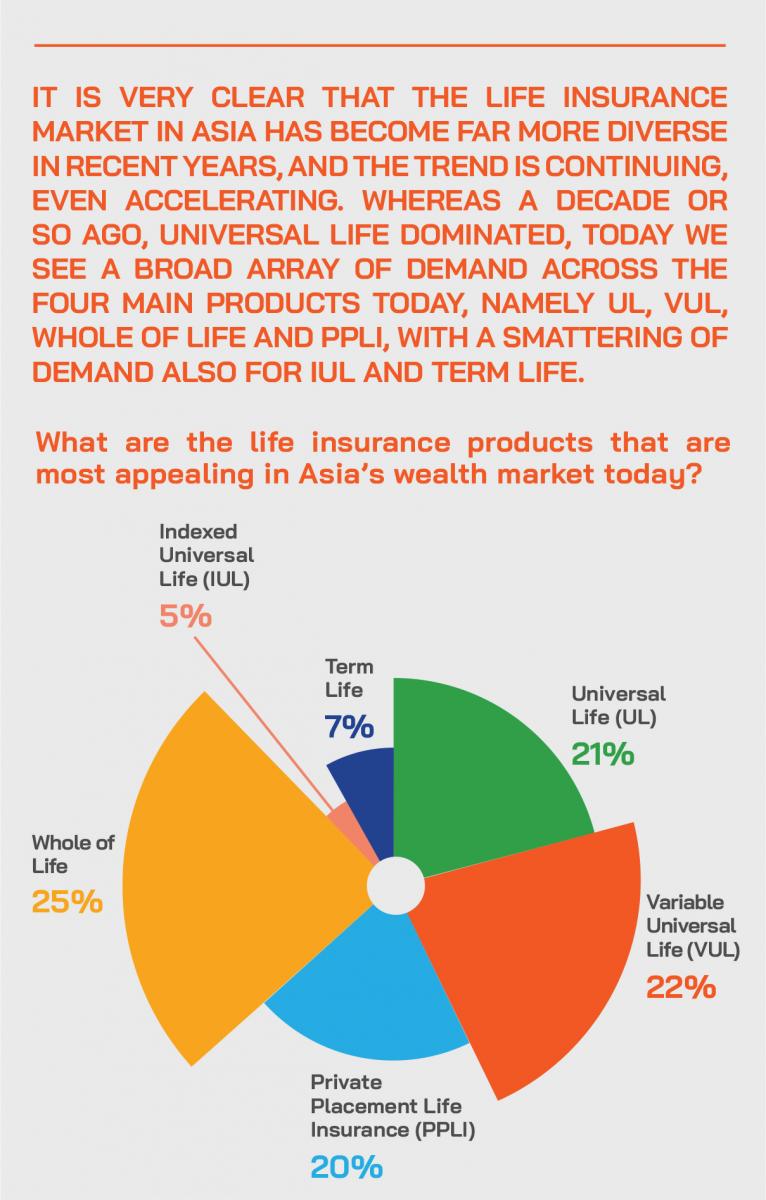

Hnw Life Insurance Riding A Wave Of Demand With A Diversified Product Range Asian Wealth Management And Asian Private Banking

Hnw Life Insurance Riding A Wave Of Demand With A Diversified Product Range Asian Wealth Management And Asian Private Banking

Life Insurance Coverage Gap Deloitte Insights

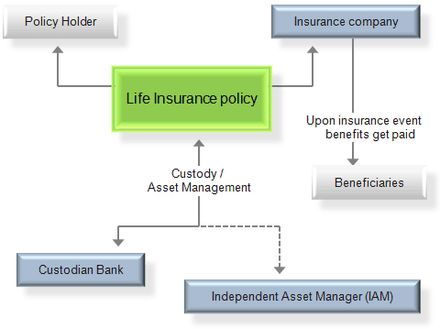

What Is Private Placement Life Insurance Lombard International

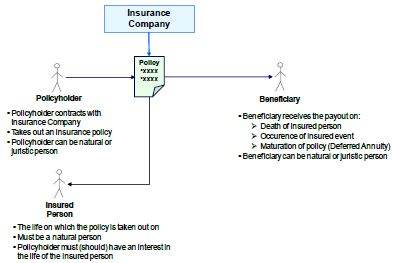

Introducing Private Placement Life Insurance Ppli Raffles Family Office

What Is Private Placement Life Insurance Lombard International

Life Insurance Coverage Gap Deloitte Insights

Life Insurance Coverage Gap Deloitte Insights

Assignment Of Life Insurance Policy Types Details Rules

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking

Introducing Private Placement Life Insurance Ppli Raffles Family Office

Private Placement Life Insurance

Private Placement Life Insurance Wikiwand

What Is Private Placement Life Insurance Lombard International